Introducing Open Equity: Buffer’s Equity Formula and Full Individual Breakdown

CEO and co-founder @ Buffer

Ever since we established the Buffer values that are at the heart of our company culture, we’ve been continuously on the lookout for new ways to live those values every day – particularly our important value of defaulting to transparency.

Last year, Buffer shared all of our salaries and the formulas behind them. We regularly share what we’re reading, how we’re working to improve ourselves – even the mistakes we make. Without this ongoing commitment, our value of transparency is little more than a word written on a piece of paper.

That’s why today we take one more step toward turning Buffer into a completely “open company” by sharing our equity structure and individual breakdown, too.

What is Open Equity?

I’ve always wanted to demystify equity. Although the concept is deeply ingrained in startup culture, it’s often a cloudy topic. Many tech companies give you options, but explaining them is so complicated that employees still struggle to know what it all means. And with Buffer being a fully distributed team, many of our team members are far outside the Silicon Valley tech world and haven’t had experience with it before.

Leo and I had no idea how to approach equity at first. We ended up doing quite a bit of research, talking with people we trust who had great guidance for us. In the end, we set aside 20% of Buffer to give out as stock options to our team and advisors.

Right now, there are 11,256,468 Buffer shares issued and available. We issue them to team members through our “Open Equity”– a simple formula to calculate equity (actually, “options” – but more on that in a minute) that is open to the whole team. Here’s how it works.

The formula

Here’s a breakdown of each element in the formula and how we calculate it.

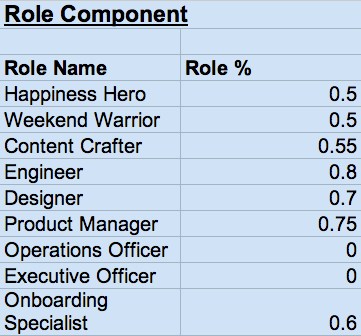

Type of role:

Each key role at Buffer carries with it a base percentage of equity. (Note: Operations and Executive Officer roles have 0 only because the roles are currently filled by Leo and I, who get zero options. We have founder equity as displayed in the table below.)

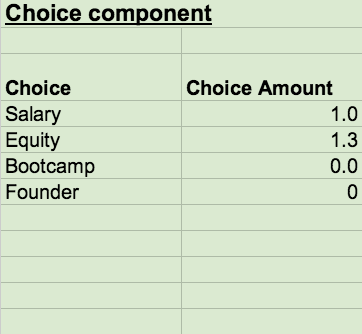

Choice:

When you finish your 2-month “Buffer Bootcamp” period and come on full-time at Buffer, you have a choice to make: $10,000 additional salary or ~30% more equity.

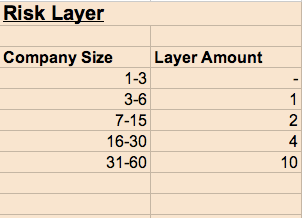

Risk Layer:

When you join a startup, there’s a big risk difference between starting as the 5th person versus starting as the 50th. For Buffer, we use the company’s size to determine a relative “risk layer to reflect this risk.

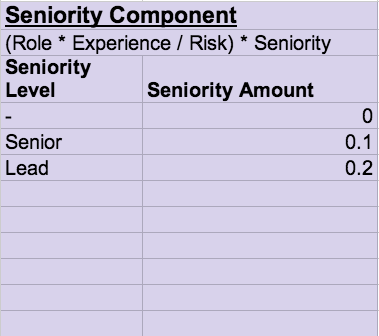

Seniority:

Right now, we have two levels of seniority: lead and senior. A lead-level team member has or will have a team to manage, while senior-level team members have shown exemplary leadership but may not have a team to manage. We are not at the size to have additional levels such as VPs just yet. In the future we will add these here.

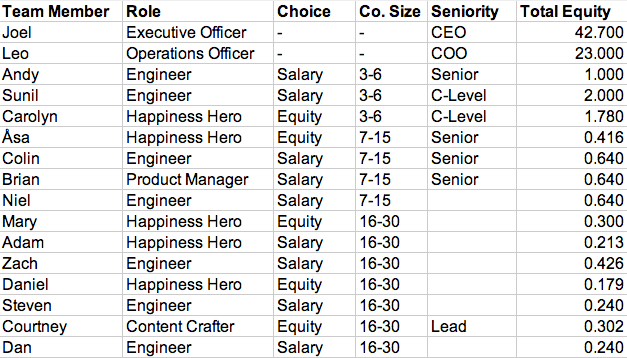

Breakdown by individual

Those are the components of the formula. Here’s how that formula breaks down in percentage equity for each member of the Buffer team today (this is an abbreviated version; you can see lots more at our open salary and equity spreadsheet).

The reason we use percentage in most areas is that this makes the concept slightly easier to grasp – it seems to be easier to understand that you hold 10% of a company’s value than that you have 1,125,646 options in a company. (An additional 500,279 options belong to a small group of Buffer advisors and former team members who retain options from partial vesting.)

Example acquisition scenarios

In general, choosing more equity means taking more risk. But a small change in equity can mean a big change in monetary outcome. So we also share with each team member a few examples of exit scenarios for Buffer. For example, let’s look at someone with options for 0.5% of Buffer:

- Buffer sells for $30M. They make $150,000.

- Buffer sells for $60M. They make $300,000.

- Buffer sells for $600M. They make $3,000,000.

Keep in mind, these figures would have to be deducted by the amount the employee pays for the options (for example $0.02/share if they are an early employee at Buffer) and any taxes that apply. So in the $150,000 example, effectively with those deductions it would become $148,874.35.

The way the number $0.02/share or $0.17/share is determined is through an outside firm valuing Buffer through a process called a 409a valuation. They come up with the price/share which can then be used to issue options for all Buffer employees. Every company has to do a new 409a valuation once a year.

Our vision for Buffer is to keep going for a long time, so we might not exit. However, there may still be opportunities for team members to sell their options along the way.

Important note: Options vs. Equity

What a team member actually gets when joining Buffer is a number of options in Buffer, not actual equity. An option, as defined by Wikipedia, means the following:

“an option is a contract which gives the buyer (the owner) the right, but not the obligation, to buy or sell an underlying asset or instrument at a specified strike price on or before a specified date.”

Say Buffer has 100 shares. When you join Buffer, you get 10% in options as part of your compensation package. This means you get 10 options, each with the right to buy 1 of the 100 shares, at a fixed price. Let’s say that price is $1. So if you want to get your 10 Buffer shares, you will pay $10 and then you will hold 10% in the company. Now, let’s say Buffer sells the company to Google for $1,000. Since you have 10 options, you can pay $10 for your 10 shares, and since Buffer just sold, you will get $100. Effectively, you will make a $90 profit – pretty sweet!

The older Buffer gets, the more valuable the company (hopefully!) becomes. So the fixed price to pay for the options also go up. As an example, when Buffer started, the first few people could pay $0.02/share. The next batch, after Buffer became more valuable, had to pay $0.17/share. So the difference between option price and the worth of the actual share went down slightly – it should always be so that it’s still very worthwhile to have these options.

Thoughts about the future of Open Equity at Buffer

I hope this is a start towards demystifying equity – at least when it comes to Buffer.

Special thanks to goes to:

Joel Spolsky: Joel’s guidance with his concept of layers that he described here has been immensely useful for us to get our formula together.

Wealthfront’s equity calculator: The Wealthfront equity calculator has also been a fantastic guide for us, as we tried to come up with equity options in our formula that were fair and would scale.

Our formula for equity – like much of what we do at Buffer – is still a work in progress. We’ll likely have to make some changes and there’s no guarantee that it will scale as we grow, but it feels good to finally make this element of Buffer open.

I’d love your thoughts, ideas and feedback on our formula and how we can improve it further. Ask me any questions at all in the comments below, or simply tell me what you think.

P.S. If you liked this post, you might enjoy our Buffer Blog newsletter. Receive each new post delivered right to your inbox! Sign up here.

Try Buffer for free

140,000+ small businesses like yours use Buffer to build their brand on social media every month

Get started nowRelated Articles

How the Buffer Customer Advocacy Team set up their book club, plus their key takeaways from their first read: Unreasonable Hospitality by Will Guidara.

In this article, the Buffer Content team shares exactly how and where we use AI in our work.

Here we go again. If you work in social media, it’s nothing new to adapt and change your strategy based on the ever-changing algorithms and the rise and fall of social networks. (Who else was on Vine? 🙋🏻♀️) But, of course, we wish you didn’t have to. The latest wave for social media marketers and creators is that TikTok might be banned in the U.S. The short-form video app has become one of the most widely-used social media platforms and is credited with impacting trends and cultural shifts.